Selling property? What are the Capital Gains Tax(CGT) implications?

2 Jul 2018 By WengYee Loke

The following information should not be construed as financial, legal or tax advice. Readers are advised to get in touch with their respective advisors for bespoke assistance where issues mentioned in this blog affect them.

If you are a landlord within the UK, you should have already heard of Section 24. A new act that will see landlords no longer be able to deduct mortgage interest or finance costs against rental income. In this blog post, together with Rita4Rent (property tax specialists) we will look at the Capital Gains Tax (CGT) implications in two different scenarios. The CGT regime can be more complex than just the two case studies we will look at. So for more tailored advice, do get in contact with Rita4Rent.

Haven’t heard of Section 24!? Have a look through our full Section 24 guide to understand how it will affect you. There is also greater detail on the fundamentals of Section 24 over on RITA4Rent’s blog.

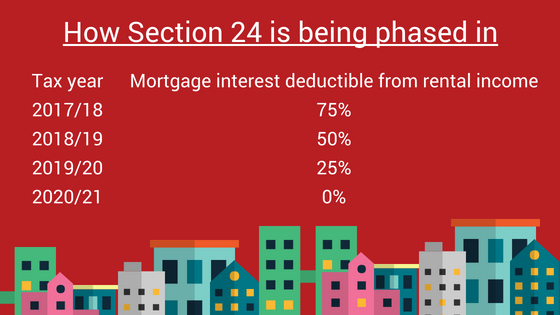

For many property owners, Section 24 has been a nudge to re-evaluate their property portfolio. It is vital that you have the means and a plan to accommodate the new tax changes. The changes are being introduced slowly to ease landlords into it. Landlords will feel the full effects of Section 24 in 2020 but it is never too early to start planning. You don’t want to find yourself with a large tax bill because you hadn’t taken the time out to look at your portfolio.

A quick look at how the tax changes will be phased in

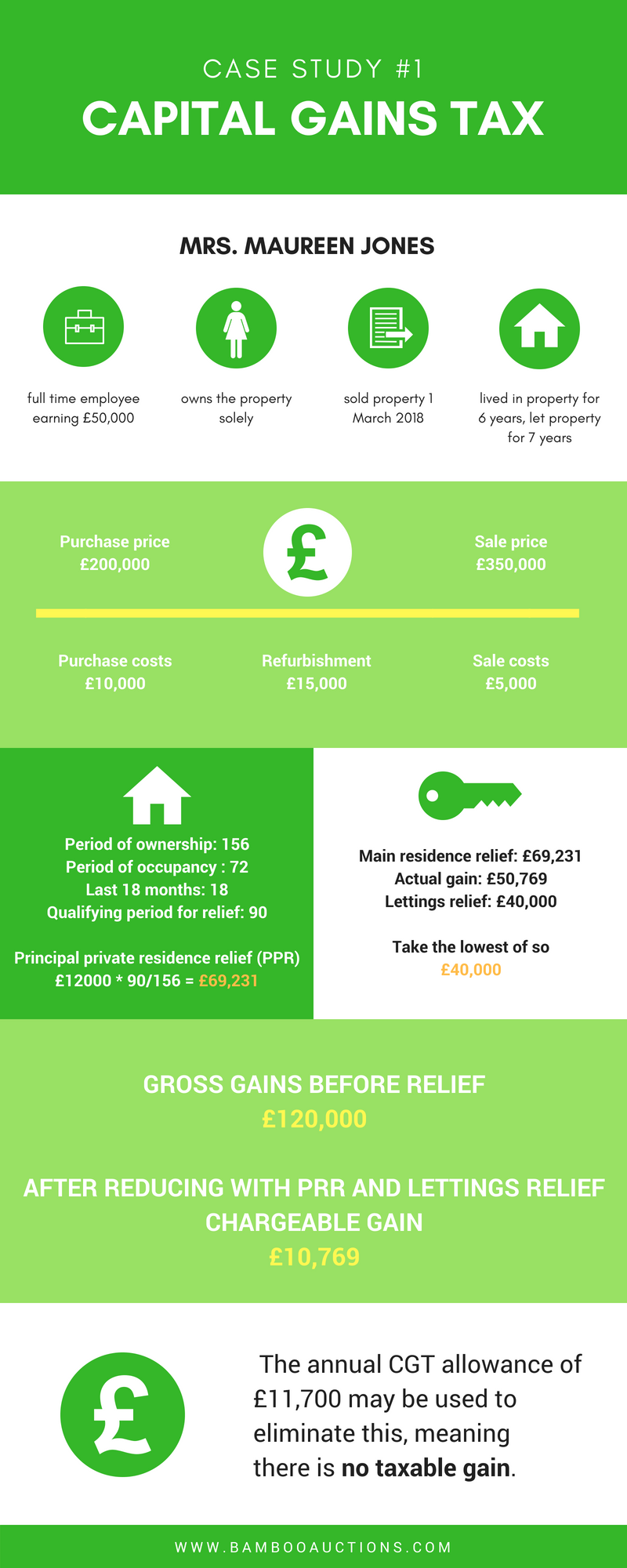

In this post, we will look at the tax position of a landlord we shall refer to as Mrs Maureen Jones, ascertaining the Capital Gains Tax (CGT) due, and illustrating this with full workings. Maureen has decided that Section 24 makes her property investment no longer viable, and sells her sole property.

Maureen is a full-time employee, a higher rate taxpayer earning £50,000 per annum (with £8,700 PAYE deducted at source using a standard tax code). The only other income she received was from the property, which she owned solely.

Maureen sold her property on 1st March 2018. This sale therefore relates to the 2017/18 tax year. She did not receive any other rental income in that tax year as the property was empty as she prepared it for sale.

She originally purchased the property for £200,000. During this purchase she incurred £10,000 in purchase costs, such as solicitor’s fees and initial capital improvement costs. After completing, she lived in the property as her main residence for 6 years.

Following her marriage, she decided to move into her husband’s home, and began letting the property, and the property was let for 7 years before the property was sold. During the period of ownership, a further £15,000 of improvements were carried out.

The property was sold on 6 April 2016 for £350,000. Maureen incurred selling costs of £5,000 which consists of estate agent commission and other selling costs.

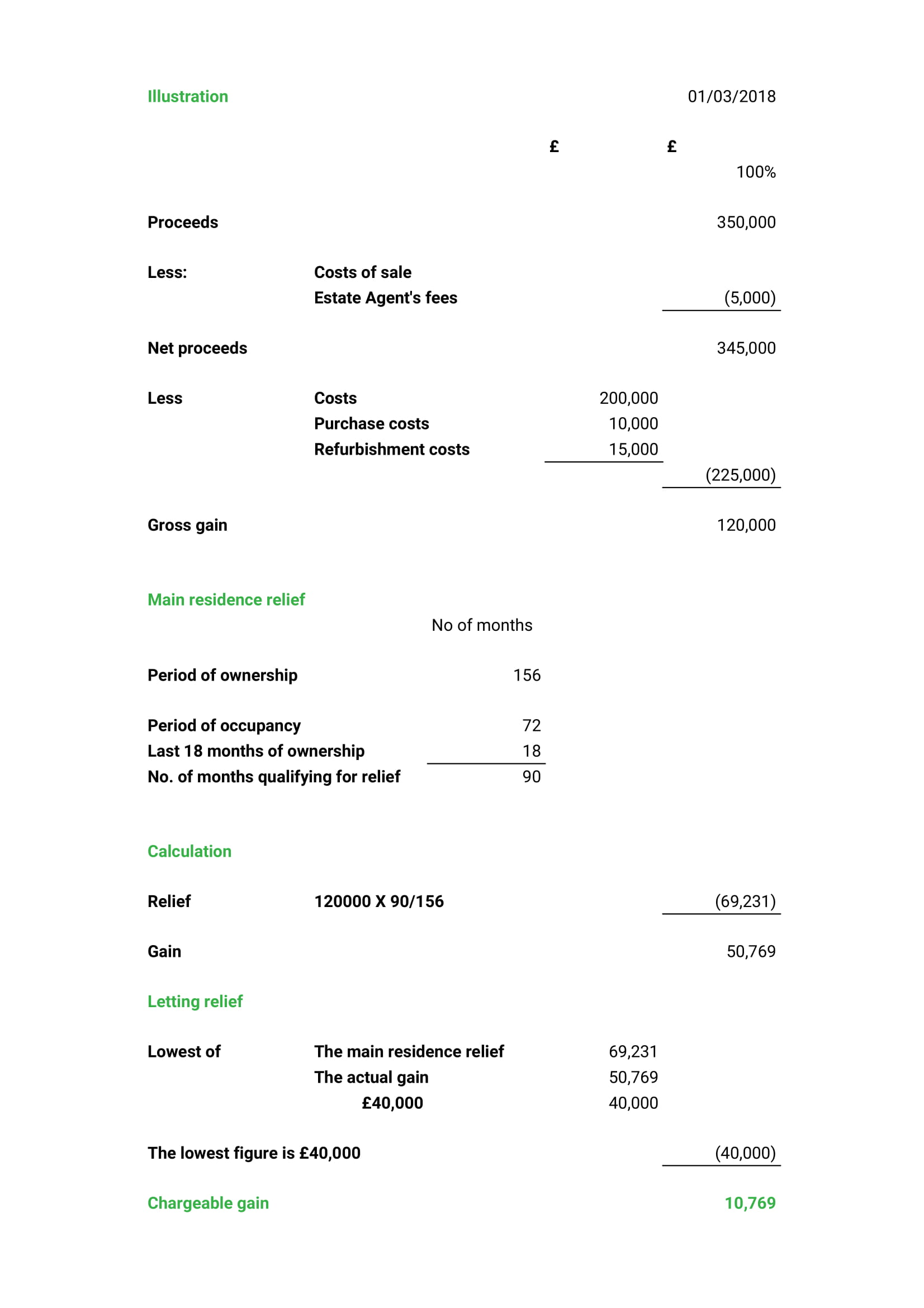

We shall first all look at how much capital gains tax Maureen is likely to pay:

Therefore, Maureen’s capital gain is covered by the £11,700 annual CGT allowance, and so no Capital Gains Tax falls due.

With reference to the above, the gross gain before reliefs is £120,000.

However, this can be reduced by PPR and Lettings Relief.

First of all, for PPR, Maureen lived in the property for 72 months, and the last 18 months of her ownership can be added this, meaning 90 months out of the total ownership period of 156 months qualify for PPR relief.

Letting relief is available when:

- You sell an investment property which is, or has been, your only or main residence, and

- Part or all of the above property has at some time in your period of ownership been let as residential accommodation.

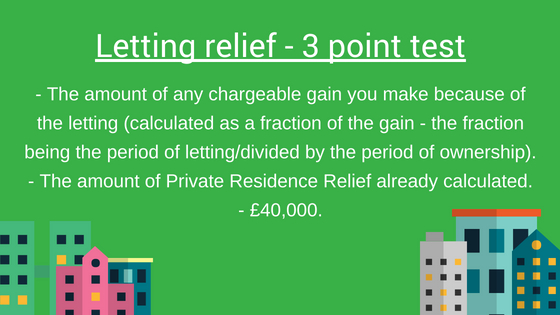

The relief which is available to reduce your capital gain, is subject to a 3 point test. The value to use is the lowest of the following:

- The amount of any chargeable gain you make because of the letting (calculated as a fraction of the gain - the fraction being the period of letting/divided by the period of ownership).

- The amount of Private Residence Relief already calculated.

- £40,000.

Therefore, with reference to the above and the calculations, £40,000 is available for relief here.

We are then left with a chargeable gain of £10,769. The annual CGT allowance of £11,700 may be used to eliminate this, meaning there is no taxable gain.

TL;DR:

But what if Maureen had never lived in the property?

Head on over to Rita4Rent’s blog for the illustration of that scenario.

If you are looking to sell property, we can help with that! Auctions provide a method of sale that is fast, certain and transparent. With the additional ease of being online, we and our partners can help you. Online auctions give you flexibility (you can even sell with tenant in situ). You get to choose the time period and exchange date. There is also no restriction like needing to make a catalogue deadline.

0 Likes 0 Shares