Looking forwards: Our economic analysis of the auction market.

15 Jun 2016 By Robin Rathore

At Bamboo Auctions, our aim is to increase the 1.9% auction market share to a figure that that truly reflects the potential of such an efficient way to sell properties. A cause of the under-use of auctions is that buyers and sellers are not aware of the effectiveness auctions, and believe the stigma that auctions are ‘a last resort’, ‘they are risky’ or that ‘your property will sell for less’. These preconceptions are wrong and the need to raise awareness is crucial.

The auction industry has for the most part, been preaching to the converted. It is mostly experienced property investors that read articles discussing success rates and amounts raised. Inviting entries emails are sent to the same databases used to advertise properties for sale. The same properties get bought and then sold, the same person is selling and then buying and there are not enough “new” buyers and sellers into the market.

Programmes such as “Homes under the Hammer” have done well to get some “new” people involved with auctions, but there is only so much that a programme shown at 11.30am on a Tuesday can do. The people that need to be targeted are not watching television at that time. Incidentally, when I asked my contemporaries, everyone had heard of the programme, but no-one had actually watched it since leaving university.

The problem in the auction market is not a shortage of new buyers. With portals and marketing, buyers can always be accessed. The way to grow the auction market beyond 1.9% is to generate supply from vendors that would not usually have considered auctions.

Online estate agents have been growing at a rapid rate and now command approximately 5% of the total property market. That’s double the auction industry. We believe that some of this growth has been fuelled by motivated, price sensitive vendors with potential auction stock. They are looking for more cost effective ways to sell their property. We know these vendors are motivated, because they are willing to pay an upfront fee to the online estate agent to sell their property…a listing fee.

Auction houses are less able to compete on prices. This is because they usually offer one service, the live room auction, which has relatively high operational costs. To cover their costs, the auction house has a minimum price that they need to charge.

Here’s where we dust off those A Level Economics textbooks…

The Economics

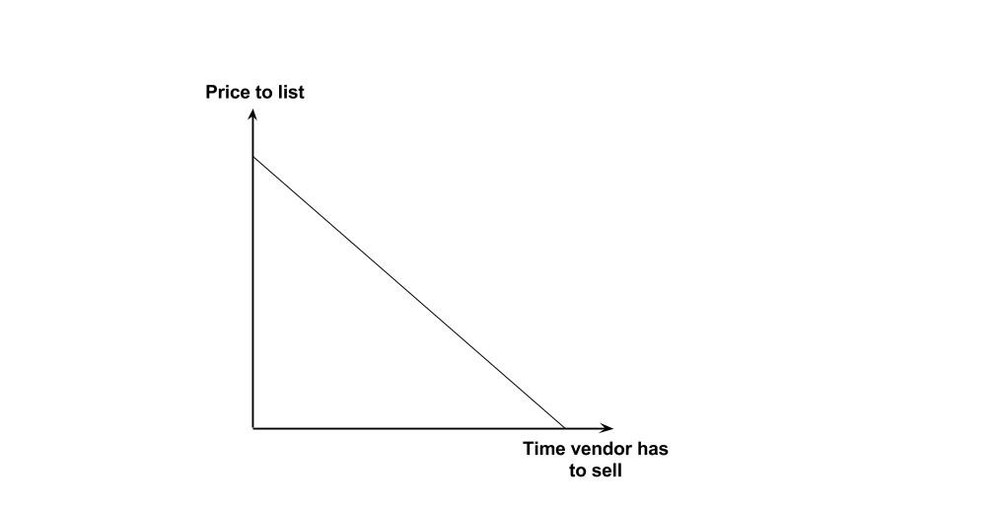

[caption id="" align=“alignnone” width=“1014.0”] The inverse relationship between listing price and the time available to vendors [/caption]

The inverse relationship between listing price and the time available to vendors [/caption]

There are three factors affecting vendors when deciding how to sell their property. Two immediate factors, that have a direct, inverse relationship, are the associated costs to sell and the time constraints the seller faces. The less time a vendor has to sell, the more they are likely to pay to sell (willingly or otherwise). The more time a vendor has to sell, the less they will want to pay; vendors in this case have more bargaining power.

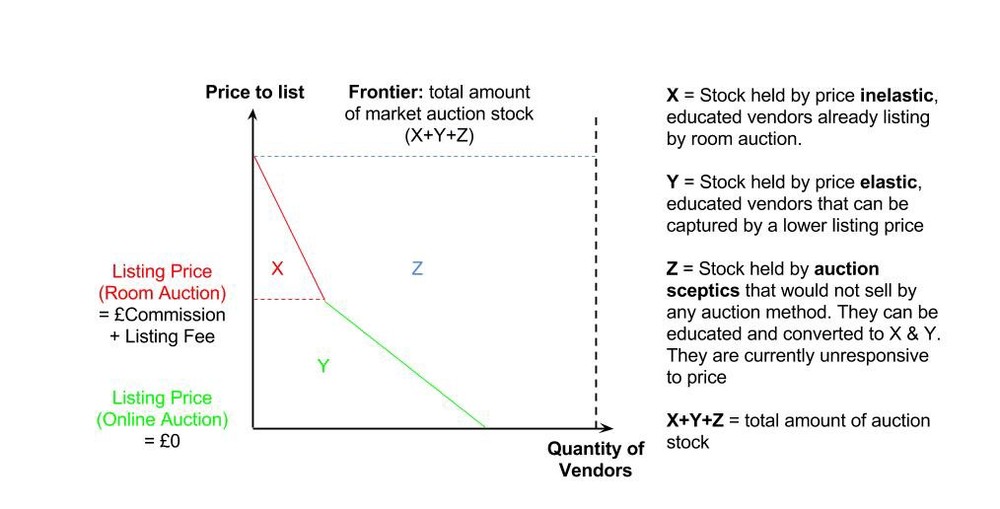

The third factor is information. Vendors who are not aware of auctions are unresponsive to price (irrespective of time), as they would never use auctions as a method of sale. They therefore fall outside the scope of the active auction market, but remain in the potential market. These vendors are represented by ‘Z’ in the graph below.

[caption id="" align=“alignnone” width=“1014.0”] Where is all the auction stock hiding? All we see is ‘X’ [/caption]

Where is all the auction stock hiding? All we see is ‘X’ [/caption]

The area X+Y+Z represents what we consider to be the total potential market of all vendors of auction-able properties.

The current auction vendor pool is represented by the area ‘X’ (i.e 1.9%). The red dotted line represents the minimum price that the auction house is able to offer to sell a property and still cover their costs. The red line is steep as these vendors are relatively price unresponsive. If an auction house was to increase the price to sell, it is less likely to deter these vendors from selling by auction. This is because other external factors are likely to be influencing their decision to sell by auction, e.g. time pressure or financial distress.

If auction houses were to offer listings at a sale price that is below their ‘minimum price’, then they could increasingly attract vendors in area ‘Y’. These vendors are those who would normally sell with a cheaper online or high street estate agents. Pricing them into the auction market would increase the vendor supply to the area ‘X+Y’. The green line is less steep than the red line, because these vendors are more likely to be price responsive. These vendors would consider selling by auction, but for the costs involved.

By raising awareness, more people in area ‘Z’ above will be brought into the market (shown by a shift in the red and green lines). The more people who sell by auction, the more others will follow, so the education process becomes self sustaining.

As discussed at this year’s RICS Auctioneering Conference, changing people’s ingrained perceptions through education is no easy task, but this should be the long term goal of the auction industry.

The short to medium term solution to increase the size of the auction market is to enable auction house to compete on price and capture more vendors. This is where Bamboo Auctions steps in. As discussed in one of our previous blogs, technological innovations such as online auctions are a great way to cut your fixed costs. These savings can be directly passed on to vendors who would never previously have thought of selling by auction. In this way, our online auction technology truly compliments the live room auction.

Bamboo Auctionsbuilds technology with your branding allowing__buyers and sellers to exchange online, immediately at the end of a specified time period. For more information or to arrange an online demonstration call 0330 088 9659 or email hello@bambooauctions.com

0 Likes 0 Shares